The $500 Billion AI Infrastructure Race: Google, Microsoft, and Global Tech Giants Battle for Datacenter Supremacy

Sponsored by CloudAssess - Your trusted partner for comprehensive cloud infrastructure assessment and optimization.

The artificial intelligence revolution has officially entered its infrastructure phase, with tech giants announcing unprecedented investment commitments that dwarf previous technology buildouts. Google's announcement of a $25 billion AI infrastructure investment across 13 US states represents just the latest salvo in what has become the most expensive technology arms race in history.

Google's Strategic Grid Play: Beyond Traditional Datacenters

Google said Tuesday it plans to invest $25 billion in artificial intelligence infrastructure in 13 states over the next two years. Another $3 billion will go towards modernizing two hydropower plants in Pennsylvania to serve data centers in the region, where the grid is under stress from soaring demand. This announcement signals a fundamental shift in how tech companies approach AI infrastructure, moving beyond simple server deployment to comprehensive grid modernization.

The focus on Pennsylvania's hydropower infrastructure is particularly strategic. The region operates under PJM Interconnection, the nation's largest electric grid covering 65 million people between Illinois, New Jersey, and West Virginia. This grid also oversees the world's biggest datacenter market, making Google's investment a play for both computational capacity and energy reliability.

What sets Google's approach apart is the integration of power generation with compute infrastructure. By investing $3 billion in hydropower modernization, Google is essentially future-proofing its operations against the energy constraints that have begun to plague AI datacenter development across the industry.

Microsoft's $80 Billion Gambit: The Largest Single-Year Investment

Microsoft has earmarked $80 billion in fiscal 2025 to build data centers designed to handle artificial intelligence workloads, with more than half of this total investment in the United States. This represents the largest single-year infrastructure investment in the company's history and potentially the largest by any technology company.

Microsoft's investment strategy appears focused on immediate deployment rather than phased rollouts. The company's president Brad Smith revealed the news in a blog post on Friday, in which he also called for the US government and tech businesses to take action to maintain American leadership in AI infrastructure.

The scale of Microsoft's commitment becomes clearer when compared to the broader market. Analyst Omdia has just raised its 2025 datacenter capex estimate from $561 billion to $576 billion, and the spending outlook for hyperscale cloud companies alone indicates capex could grow by more than 30 percent this year. Microsoft's $80 billion represents nearly 14% of global datacenter spending for the entire year.

The Stargate Project: OpenAI's $500 Billion Moonshot

Perhaps the most audacious announcement comes from OpenAI's Stargate Project. The Stargate Project is a new company which intends to invest $500 billion over the next four years building new AI infrastructure for OpenAI in the United States. We will begin deploying $100 billion immediately.

This partnership between OpenAI, SoftBank, and Oracle represents more than just infrastructure investment—it's a statement of intent about the future of AI development. One of OpenAI's future data centers has reportedly secured $11.6 billion in funding commitments. The center, set to become the ChatGPT maker's largest, indicates the scale of individual facilities being planned.

The immediacy of the $100 billion deployment suggests that OpenAI believes current infrastructure limitations are the primary constraint on AI advancement, rather than algorithmic improvements or talent acquisition.

Amazon's Project Rainier: The Quiet Giant's Response

While less publicized, Amazon's infrastructure investments may be the most significant of all. Amazon won't comment on the cost of Rainier by itself, the company has indicated it expects to invest some $100 billion in 2025, with the majority going toward AWS. The sense of competition is fierce. Amazon claims the finished Project Rainier will be "the world's largest AI datacenter."

Amazon's approach differs from its competitors by focusing on infrastructure-as-a-service rather than proprietary AI development. This strategy positions AWS as the backbone for other companies' AI ambitions while Amazon develops its own capabilities through partnerships, including expanded investment in Anthropic.

Alibaba's Global Challenge: China's $53 Billion Counter-Move

The infrastructure race extends beyond American shores. Alibaba Group Holding Ltd. pledged to invest more than 380 billion yuan ($53 billion) on AI infrastructure such as data centers over the next three years, representing China's most significant AI infrastructure commitment.

The spending over the next three years is more than half the US$100 billion the US plans for its Stargate project. This comparison highlights the global nature of the AI infrastructure race, with Chinese companies positioning themselves as serious competitors to American tech giants.

Alibaba's investment timeline—spread over three years rather than the more aggressive single-year commitments from US companies—suggests a more measured approach that prioritizes sustainable growth over rapid deployment.

Oracle's Stealth Success: The Infrastructure Enabler

Perhaps the most surprising player in this race is Oracle, which has quietly become a major force in AI infrastructure. Larry Ellison was willing to take that risk, and committed to >2GW of capacity from November 2023 to January 2025. Oracle was the single largest lessor of datacenter capacity in the US over that period.

Oracle's strategy focuses on providing the foundation for other companies' AI ambitions rather than competing directly in AI development. This approach has proven highly successful, with Oracle becoming a critical partner in major projects like Stargate while maintaining its own infrastructure expansion.

The Scale Challenge: From Gigawatts to Exascale

The numbers being discussed represent a fundamental shift in computational scale. The CEO of generative AI company Anthropic said that $100 billion data centers are on the horizon. Dario Amodei, who co-founded the company in 2021 after quitting OpenAI, discussed the growth of data center cluster sizes during a five-hour podcast, indicating that today's massive investments are just the beginning.

The leading frontier AI model training clusters have scaled to 100,000 GPUs this year, with 300,000+ GPUs clusters in the works for 2025. This represents an order of magnitude increase in computational density that requires not just more datacenters, but fundamentally different approaches to power distribution, cooling, and network architecture.

Infrastructure as Competitive Advantage

These investments represent more than just capacity expansion—they're attempts to create sustainable competitive advantages in the AI era. Companies that can build and operate the largest, most efficient AI infrastructure will have fundamental advantages in:

Model Training Speed: Larger clusters enable faster iteration cycles and more ambitious model architectures.

Inference Economics: Efficient infrastructure directly translates to lower costs for serving AI applications at scale.

Energy Efficiency: Early movers in grid integration and renewable energy will have lasting cost advantages.

Talent Attraction: The most advanced infrastructure attracts the best AI researchers and engineers.

The Power Grid Reality Check

The most significant constraint on this infrastructure race may not be capital or technology, but electrical grid capacity. Google's Pennsylvania hydropower investment acknowledges this reality, while other companies are likely to face similar challenges.

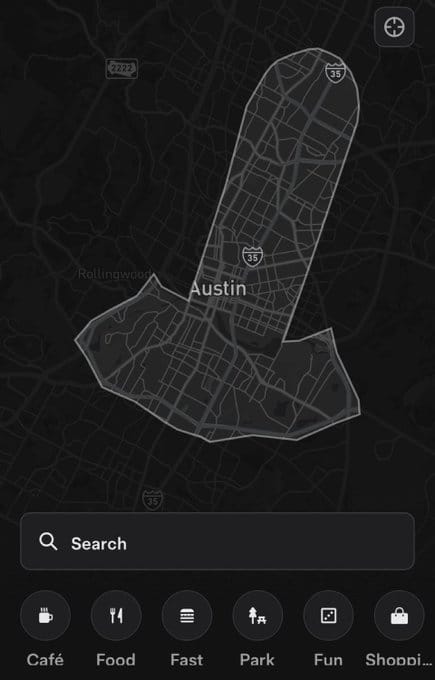

The concentration of AI infrastructure in specific regions—particularly Texas, Virginia, and the Pacific Northwest—is creating unprecedented strain on local grids. This geographic clustering effect may force companies to either invest in power generation (as Google is doing) or distribute their infrastructure more widely across regions with available grid capacity.

Looking Forward: The Next Phase

The current wave of announcements represents the initial phase of AI infrastructure buildout. The true test will come as these facilities come online over the next 18-24 months and companies begin to realize the operational challenges of running AI workloads at unprecedented scale.

Key challenges ahead include:

Grid Integration: Ensuring reliable power delivery for facilities that may consume as much electricity as small cities.

Cooling Innovation: Developing efficient cooling systems for the heat loads generated by dense AI chip deployments.

Network Optimization: Building the high-speed, low-latency networks needed for distributed AI training.

Talent Development: Training the workforce needed to operate and maintain these complex facilities.

The Trillion-Dollar Question

The combined infrastructure investments announced by major tech companies now exceed $700 billion over the next four years. This represents the largest private infrastructure investment in history, dwarfing previous technology buildouts including the internet backbone, mobile networks, and cloud computing.

The ultimate question is whether these investments will generate returns commensurate with their scale. The companies making these bets are wagering that AI will become the dominant computing paradigm, making current infrastructure investments essential for long-term competitiveness.

For the broader technology industry, these investments create both opportunities and challenges. Smaller AI companies may find themselves increasingly dependent on infrastructure provided by the same companies they're trying to compete with. Meanwhile, the scale of investment required may create barriers to entry that consolidate the AI industry around a few major players.

Conclusion: The Infrastructure Imperative

The AI infrastructure race represents more than just technology competition—it's a fundamental reshaping of the digital economy's foundation. Companies that successfully build and operate massive AI infrastructure will likely dominate the next decade of technology innovation, while those that fail to secure adequate infrastructure access may find themselves relegated to secondary roles.

Google's $25 billion investment, Microsoft's $80 billion commitment, OpenAI's $500 billion Stargate project, and Amazon's Project Rainier represent just the beginning of this transformation. As these facilities come online and begin training the next generation of AI models, we'll discover whether the current investment levels are sufficient—or if even larger commitments will be required to maintain competitive advantage in the AI era.

The race to build the infrastructure that will power artificial intelligence has begun in earnest, and the winners will likely determine the direction of technology development for decades to come.

This article was sponsored by CloudAssess, your comprehensive solution for cloud infrastructure assessment and optimization. Our platform helps organizations evaluate, optimize, and scale their cloud infrastructure to meet the demands of AI workloads and modern applications.